Table of Contents

ToggleFor businesses of all sizes, labour costs represent one of the most significant expenses. However, the true cost of labour extends far beyond salaries and wages. The “labour burden rate” is a crucial metric that captures these additional costs, and understanding it is vital for accurate budgeting, pricing, and workforce management.

What Is the Labour Burden Rate?

The labour burden rate refers to the total indirect costs associated with employing workers, expressed as a percentage of their base salary or wage. These costs include mandatory expenses like payroll taxes and benefits, as well as discretionary costs such as training and employee perks. By calculating the labour burden rate, businesses can more accurately determine the full cost of their workforce and set realistic project pricing or staffing budgets.

Components of the Labour Burden Rate

The labour burden rate typically includes the following components:

- Payroll Taxes: Social Security, Medicare, unemployment insurance, and other government-mandated contributions.

- Employee Benefits: Health insurance, retirement contributions, paid time off, and other perks.

- Workers’ Compensation Insurance: Premiums paid to protect employees in case of work-related injuries.

- Training and Development Costs: Expenses for onboarding, skills training, and professional development.

- Overhead Costs: Costs for tools, software, or workspace allocated to individual employees.

Read more: The Importance of Payroll Audits for Every Business

Why Is the Labour Burden Rate Important?

Understanding the labour burden rate enables businesses to:

- Price Projects Accurately: For project-based businesses, the labour burden rate ensures that quotes include all labour-related costs, reducing the risk of underpricing.

- Improve Financial Planning: Accurate labour cost forecasting helps maintain profitability and avoid unexpected expenses.

- Assess Workforce Efficiency: Knowing the true cost of labour aids in evaluating the return on investment (ROI) for employees and departments.

How to Calculate the Labour Burden Rate

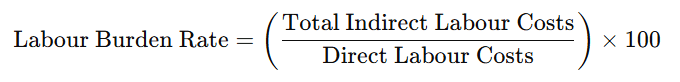

To calculate the labour burden rate, divide the total indirect labour costs by direct labour costs (base wages) and multiply by 100 to express it as a percentage:

For example, if a company’s indirect labour costs total $20,000 and its direct labour costs are $80,000, the labour burden rate would be 25%.

How Employer of Record (EOR) Services Simplify Labour Burden Management

Managing labour costs and compliance can be complex, especially for businesses with global or remote teams. This is where Employer of Record (EOR) services come in. An EOR acts as the legal employer on behalf of a company, taking on responsibilities such as payroll, benefits administration, tax compliance, and more. Here’s how EORs can help with labour burden rate management:

- Streamlined Payroll and Compliance: EORs handle payroll processing and ensure compliance with local labour laws, reducing the administrative burden on your HR team.

- Cost Transparency: EORs provide detailed breakdowns of labour costs, helping businesses understand and manage their labour burden rate effectively.

- Access to Global Talent: For companies expanding internationally, EORs navigate the complexities of foreign labour regulations, minimising risks and unexpected costs.

- Scalability: EORs enable businesses to scale their workforce without worrying about the added administrative overhead or compliance issues.

Read more: The Advantages of Payroll Services: Streamlining Your Business with Employer of Record Services

Conclusion: Optimise Labour Costs with EOR Services

The labour burden rate is a key metric for understanding the true cost of employing a workforce. By accurately calculating and managing this rate, businesses can improve financial planning and operational efficiency. However, navigating the complexities of labour costs and compliance can be challenging. That’s where an EOR can make a significant difference.

As an experienced Employer of Record service provider, we simplify workforce management, reduce administrative burdens, and help you focus on growing your business. Contact us today to learn how we can help you optimise your labour costs and streamline your HR operations. Check our services here or book a free consultation now.

Photo by Kemal Kozbaev on Unsplash