Table of Contents

ToggleCross-border taxation poses a variety of challenges for individuals and businesses operating internationally. These challenges stem from the complex interaction of tax laws between different countries.

What is cross-border taxation?

Cross-border taxation refers to the taxation of individuals and businesses that operate or generate income in more than one country. When entities engage in international activities, they become subject to the tax laws and regulations of the countries where they operate, and the interaction between these tax systems can lead to complex issues. The primary goal of cross-border taxation is to ensure that income is appropriately taxed without causing double taxation (being taxed in more than one jurisdiction) or leaving gaps where income goes untaxed.

It encompasses a range of activities and individuals, including:

- Individuals living, working, or investing in a different country than their citizenship.

- Businesses operating or conducting transactions in multiple countries.

- Multinational companies with subsidiaries or activities spread across various jurisdictions.

What are the challenges surrounding cross-border taxation?

Understanding the intricacies of taxation in itself can be confusing, and adding international tax laws to the mix makes it even more difficult.

“Tax laws governing cross-border transactions are both arcane and complex, and they present a host of traps,” writes the Journal of Accountancy. It “demands familiarity with the basic tax rules” of both countries involved, it adds.

Here are some key challenges:

Differing Tax Systems

Varying Tax Rates

Different countries have different tax rates for income, corporate profits, and other forms of taxation. This can lead to complexities in determining the overall tax liability for individuals and businesses operating across borders.

Tax Jurisdictions

Understanding which country has the right to tax specific types of income can be challenging. Dual taxation may occur when more than one country claims the right to tax the same income.

Double Taxation

Double taxation happens when the same income or asset is taxed by two or more countries, leading to an unfair burden on taxpayers. The lack of global coordination and inconsistent tax rules across jurisdictions are major contributors to this issue.

Transfer Pricing

Arm’s Length Principle

Many multinational companies engage in intra-group transactions, and determining a fair transfer price for goods, services, or intellectual property between related entities in different countries is a complex task. Tax authorities scrutinize these transactions to prevent profit shifting.

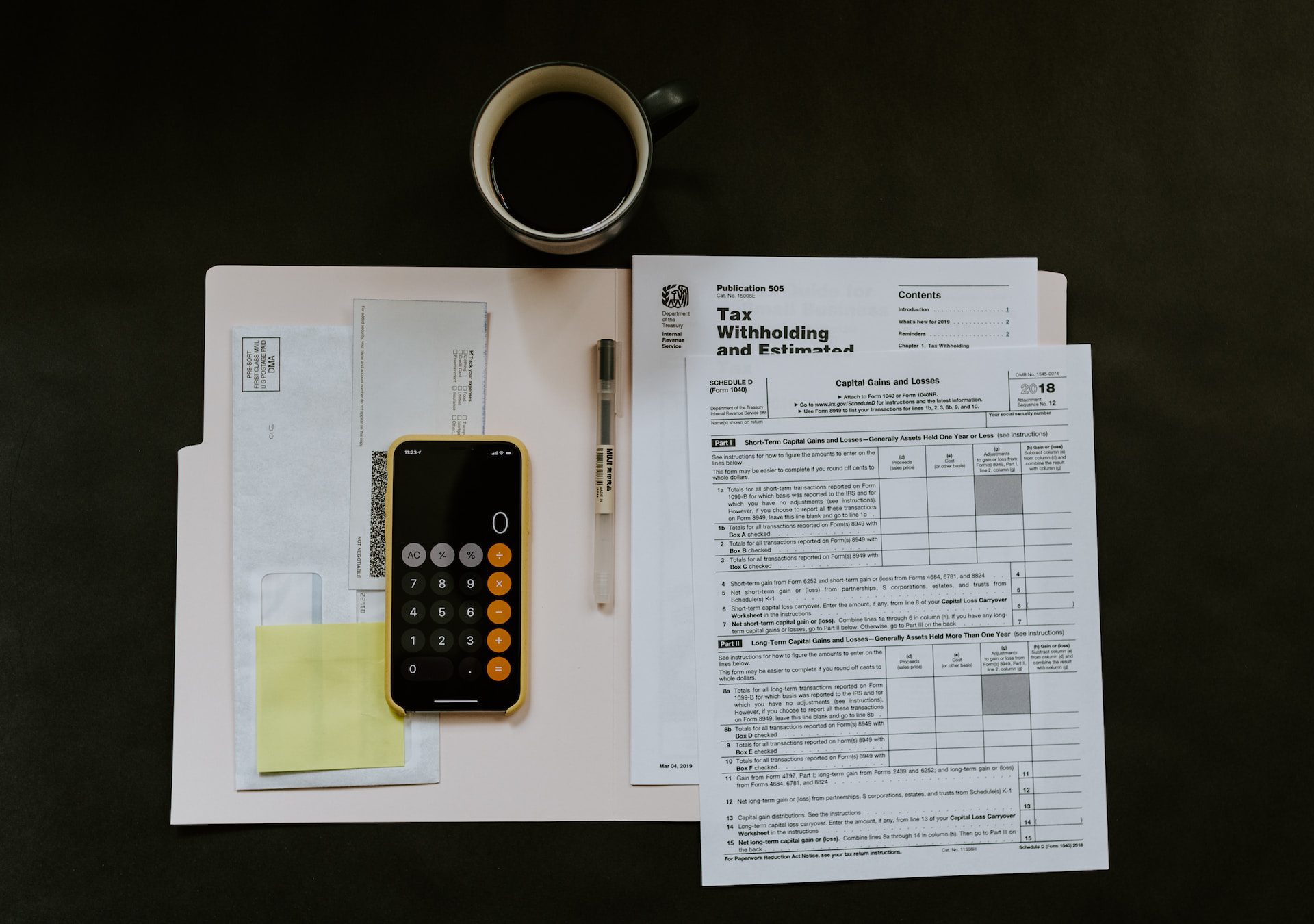

Compliance and Reporting Requirements

Complexity of Forms and Filings

Businesses operating in multiple jurisdictions need to comply with various tax forms and reporting requirements in each country. This can be time-consuming and requires a deep understanding of each country’s tax laws.

Country-Specific Regulations

Each country has its own rules and regulations regarding tax compliance. Keeping up with these requirements and ensuring adherence can be a significant challenge.

Permanent Establishment (PE)

Determining PE Status

The concept of a permanent establishment is crucial in international taxation. Establishing when a foreign entity has a sufficient presence in a country to be subject to taxation is often a complex and subjective matter.

Withholding Taxes

Complexity in Withholding Requirements

Countries often impose withholding taxes on payments made to non-residents. Understanding and complying with these requirements can be challenging, especially considering variations in rates and applicable exemptions.

Tax Treaties and Agreements

Interpretation and Application

While tax treaties exist to prevent double taxation and provide guidelines on the allocation of taxing rights between countries, interpreting and applying these treaties can be complex due to differences in legal systems and interpretations.

Exchange of Information

Data Sharing

Increasing global efforts to combat tax evasion and promote transparency have led to more extensive information exchange between tax authorities. Managing the exchange of sensitive information while ensuring privacy and data security can be a challenge.

Evolving Regulatory Landscape

Changing Regulations

Tax laws and regulations are subject to continuous change. Staying abreast of updates and ensuring compliance with new legislation in multiple jurisdictions is a perpetual challenge for individuals and businesses operating internationally.

How do you deal with these issues?

Addressing these challenges requires careful planning, international tax expertise, and, in some cases, the assistance of tax professionals who specialize in cross-border taxation. It’s crucial for businesses and individuals to be proactive in understanding the tax implications of their international activities to avoid potential pitfalls and ensure compliance.

One good way to take care of these issues is to outsource your tax and other financial matters to a third party provider. Employer of Record (EOR) and Professional Employer Organisation (PEO) agencies like Eos have trained professionals who have an expertise in taking care of cross-border tax matters, enabling partner clients to focus on their own business goals. To learn more about how Eos, with its 12 years of experience as an EOR provider, can help your company, visit our website or contact us here.

Featured photo by Towfiqu barbhuiya on Unsplash